SiennaLend User Guide

SiennaLend provides liquidity, lending and borrowing on the first-ever private DeFi lending protocol.

SiennaLend—the first-ever private DeFi lending protocol—is live on mainnet!

Follow the steps outlined in this guide to provide liquidity for lending pools, and to privately lend and borrow assets.

Before you get started (pre-requisites)

If you are new to the Secret Network ecosystem, you will need to complete a few preliminary steps.

Note: The APY rates in the included screenshots may be inaccurate.

Step 1: Create a Keplr Wallet account.

To interact with Secret Network dApps, you will need to connect your Keplr wallet. Set the network to Secret Network. We have some SCRT tokens in our wallet for gas fees. Go here to install the app or watch this tutorial.

Note: Want to protect your identity? Use the Secret Wallet Guide to create a wallet that cannot be linked to a public wallet, centralized exchange (CEX), or doxxed address in any way.

Step 2: Gather some $SCRT for Gas Fees.

You can get SCRT via direct pay, CEXs and decentralized exchanges (DEXs) on Secret, or as a wrapped ERC-20 version from DEXs on Ethereum (note that you will need native SCRT for gas) — find all your options here.

How to Provide Liquidity and Lend Assets on SiennaLend

Here are the steps you need to take to provide liquidity for SiennaLend markets. Make sure you are connected to your Keplr wallet before starting (and ensure you have a sufficient SCRT balance for gas fees. 1–2 SCRT should be enough).

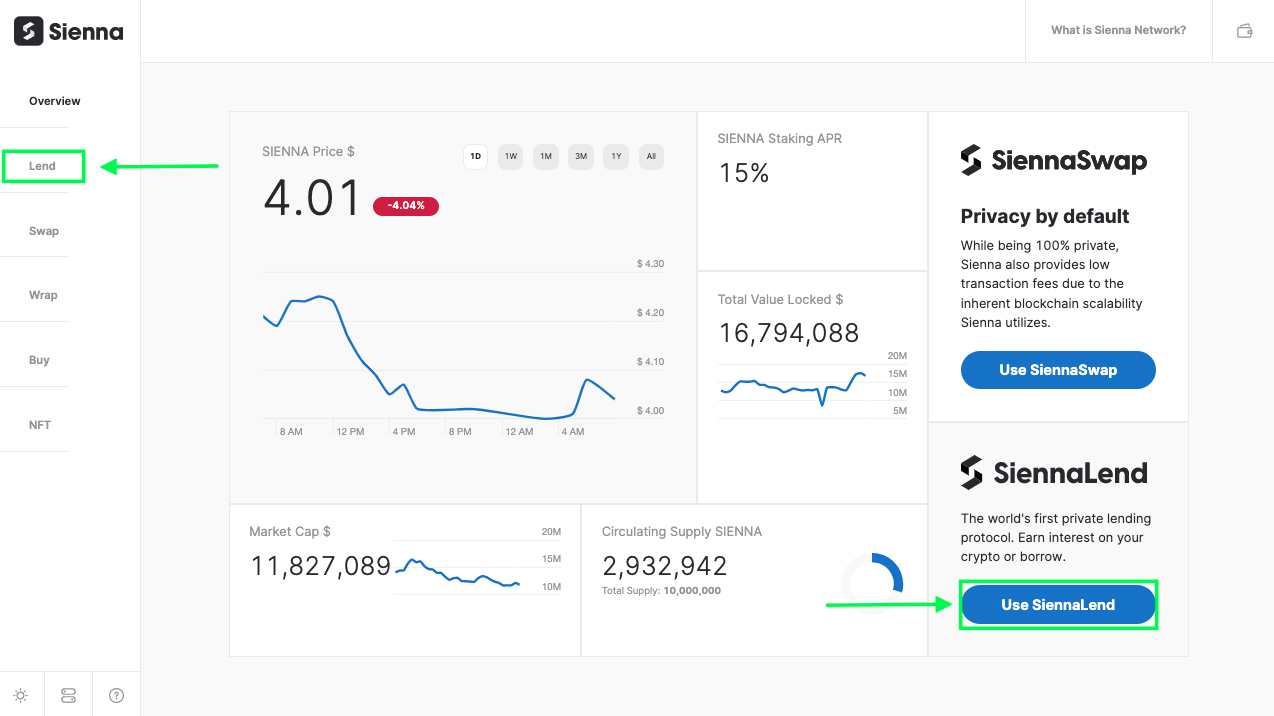

Step 1: Head over to the Sienna Network app.

Select “Lend” from the menu on the left-side of the app. Similarly, you can click on the “Use SiennaLend” button on the right-side of the app.

Step 2: Select “Deposit” on the Lend page.

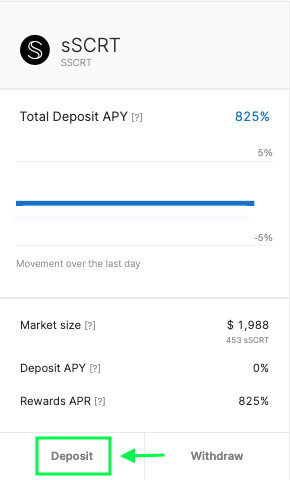

Step 3: Select the lending market you want to deposit liquidity for.

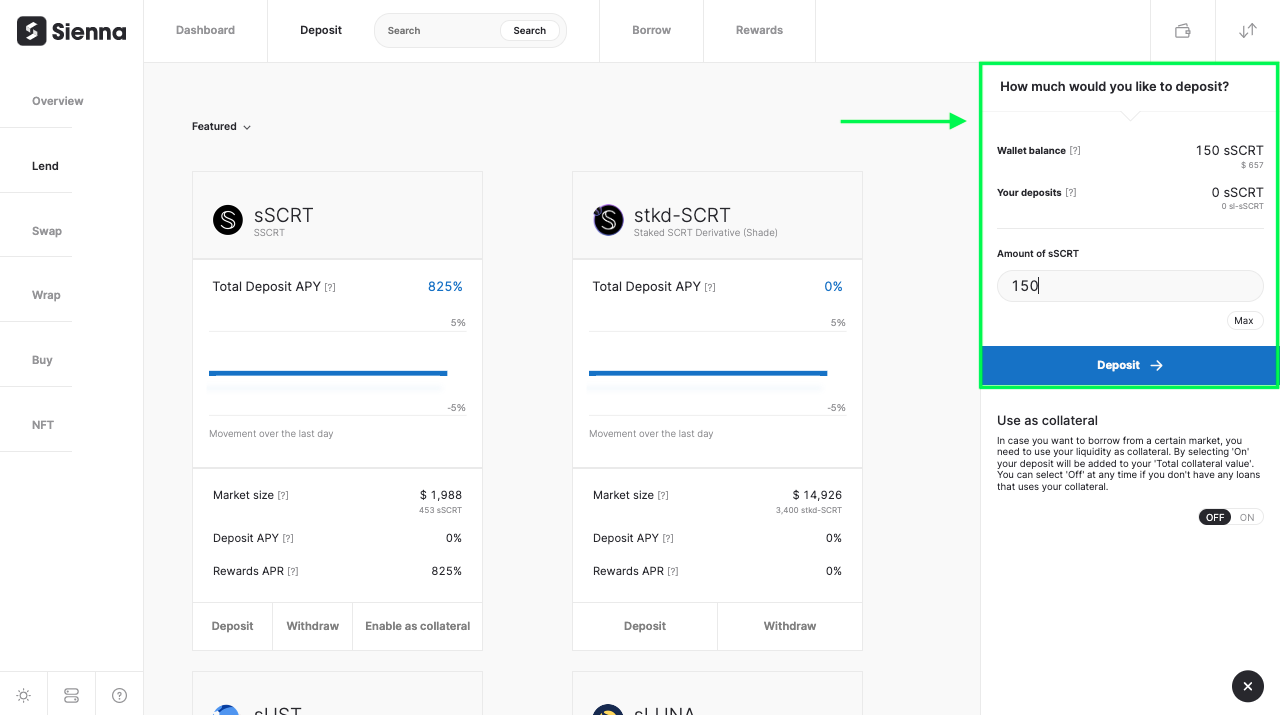

Select your desired lending pool and click on “Deposit”. For this example, we will make a deposit into the sSCRT lending pool.

After clicking on “Deposit”, you will be prompted to select your desired deposit amount. Input your desired deposit amount and click on “Deposit” (and approve the transaction in the Keplr pop-up) to broadcast the transaction.

You have now successfully made a deposit into a lending pool. Your deposited liquidity is now being used by borrowers for loans. You can either stake your SL (SiennaLend) tokens in their corresponding rewards contract to earn yield, or use them as collateral to take out a loan.

How to Stake SL Tokens to Earn Yield on SiennaLend

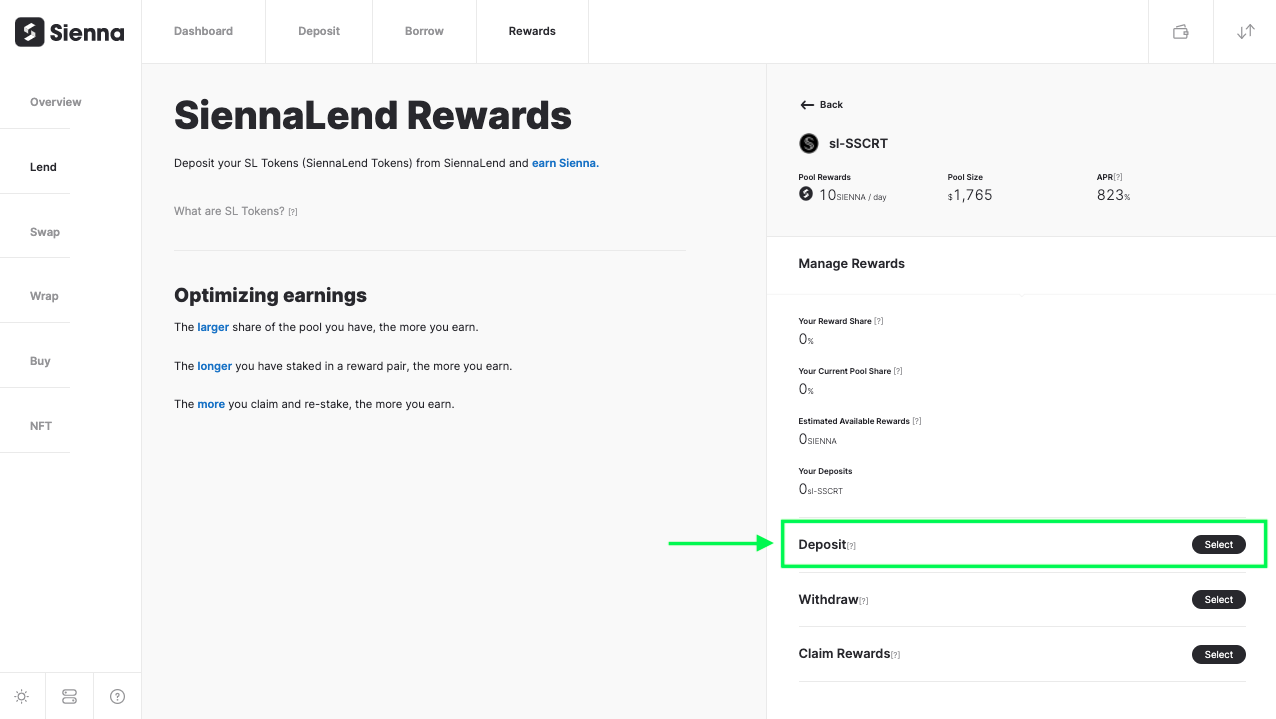

Step 1: To stake your SL tokens in their corresponding rewards contract, you will need to go to the “Rewards” page available at the top of the Lend interface.

Step 2: In the rewards page, you will see all the lending pools you have deposited liquidity into. Select the pool you want to earn rewards on and click on “Deposit”.

Step 3: You will be prompted to specify the amount of SL tokens you want to stake in the rewards contract. Select your desired amount and click on “Deposit” to broadcast the transaction.

You are now earning yield on your staked SL Tokens. Enjoy your lending APR!

How to Borrow and Repay Loans on SiennaLend

How to Borrow

To use your deposited liquidity as collateral for a loan, follow the steps outlined below.

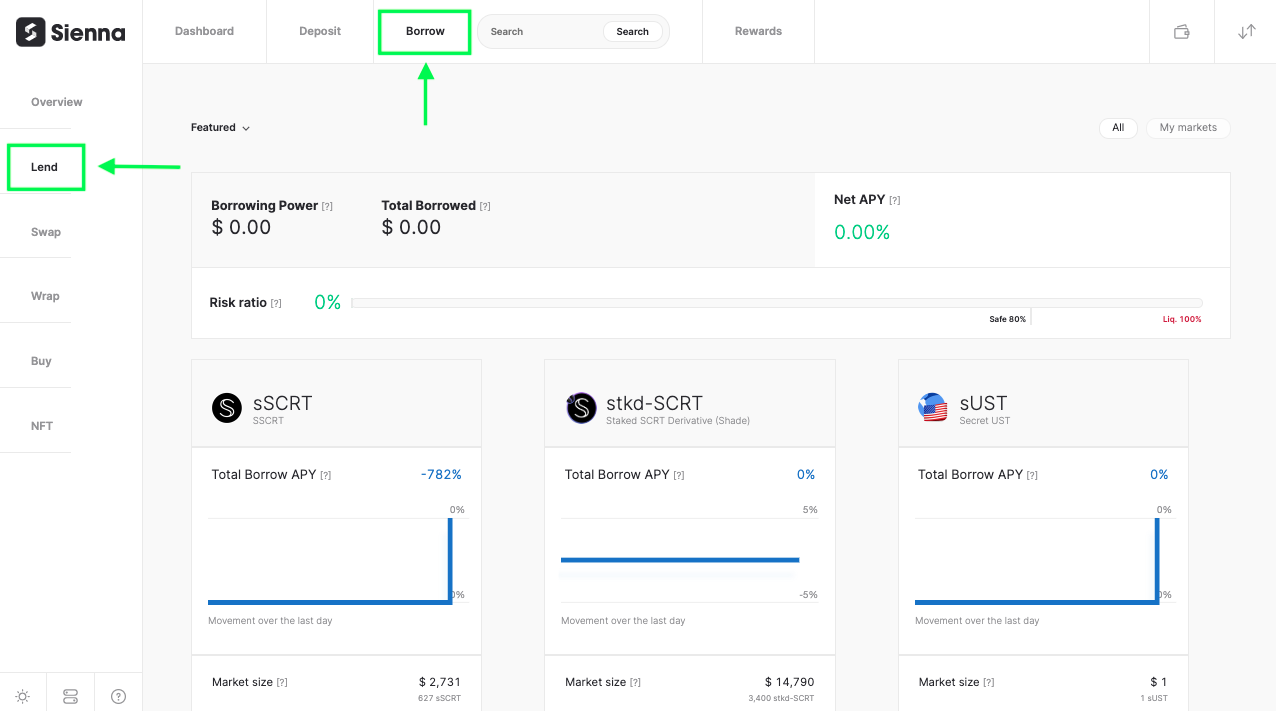

Step 1: Go to the “Borrow” page available at the top of the Lend interface.

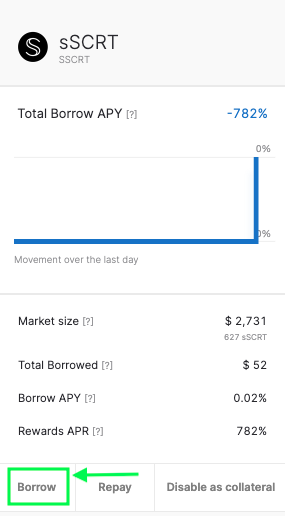

Step 2: Find the lending market you would like to to utilize for borrowing. For this example we will use sSCRT.

Step 3: Click on “Enable as collateral” to deposit your liquidity as collateral for a loan.

Step 4: After you have enabled your liquidity as collateral, click on “Borrow” to take out a loan against your provided collateral.

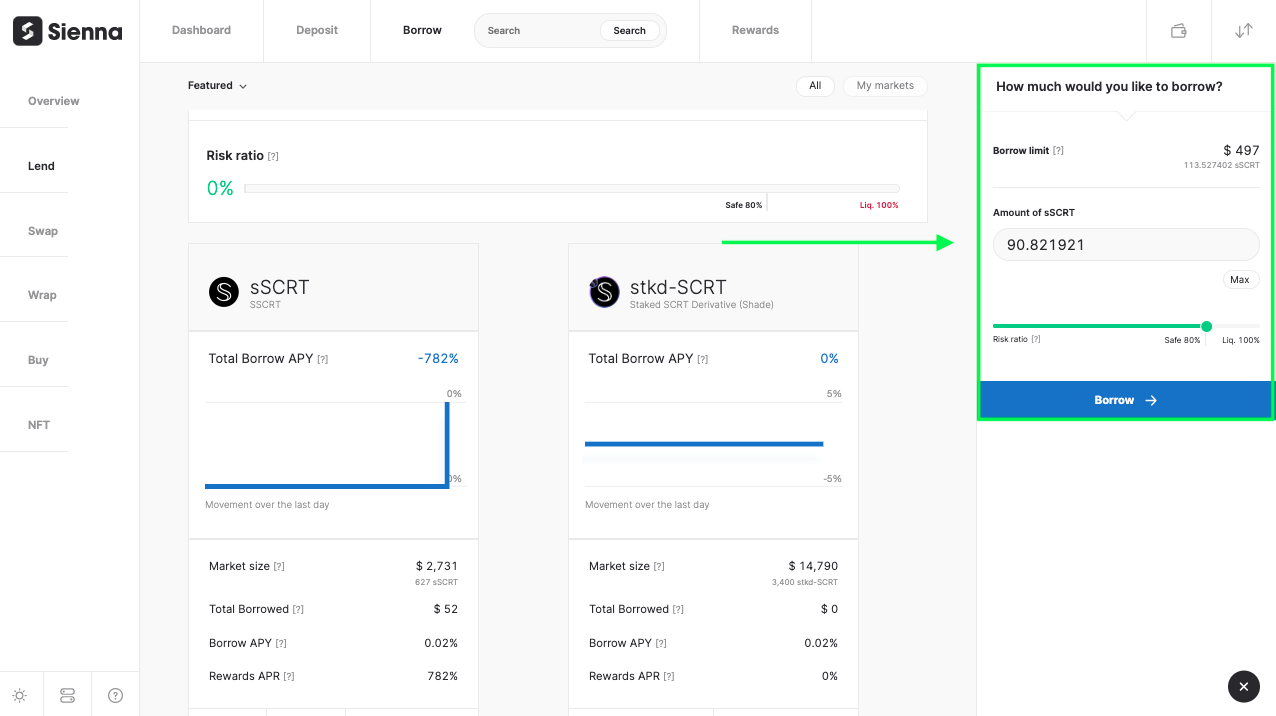

Step 5: You will then be prompted to specify the amount you would like to borrow (up to 80% of your provided collateral value is the maximum upper limit we recommend. You can actually take out a loan worth 95% of your provided collateral value, but this is significantly riskier and is not recommended). Specify an amount and click on “Borrow” to broadcast the transaction.

You have now successfully taken out a loan against your collateral!

After taking out a loan, you can monitor your risk ratio on the “Borrow” page. If the collateral value drops, your risk of liquidation increases. When your risk ratio hits 100%, your loan is liquidated and your provided collateral is used to cover the loan.

How to Repay a Loan

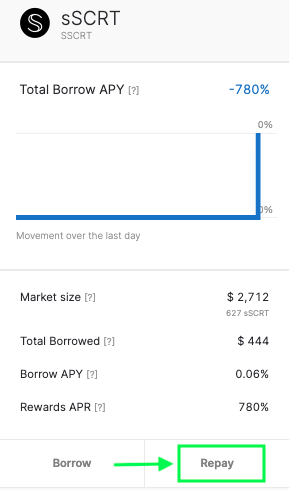

Step 1: Go to the “Borrow” page available at the top of the Lend interface.

Step 2: Find the lending market you would like to repay a loan for. For this example we will use sSCRT. Click on “Repay”.

Step 3: You will then be prompted to specify the amount you would like to repay. Specify an amount and click on “Repay” to broadcast the transaction.

You have now successfully repaid your loan!

Once you have repaid your loan, you can disable your collateral and deposit your SL tokens back into the SiennaLend rewards contracts to continue earning yield.

What’s Next?

Guide for setting up liquidator bots is in development. Will be shared with the community soon.